January 1st, 2021 marked the introduction of new European legislation on the responsible sourcing of minerals, referred to as the conflict minerals regulations. Since then, European Union based companies that import minerals have been officially required to ensure due diligence when sourcing these materials. But what exactly do these conflict mineral regulations imply and what will they change in Europe and the conflict zones?

The regulation has been demanded for a long time from both the civil society and the European Parliament, regularly highlighted by the absence of any obligation for European companies to identify the source of the minerals they purchase.

The regulations apply to minerals and metals of:

The aim of the regulations is to:

While the conflict minerals regulations apply directly to between 600-1000 EU importers, it will also indirectly affect an estimated 500 smelters and refiners of tungsten, tin, gold, tantalum, regardless of if they are in the EU or not. Production of goods often involves several companies undertaking various tasks along the supply chain.

While the conflict minerals regulations apply directly to between 600-1000 EU importers, it will also indirectly affect an estimated 500 smelters and refiners of tungsten, tin, gold, tantalum, regardless of if they are in the EU or not. Production of goods often involves several companies undertaking various tasks along the supply chain.

Image source: European Commission

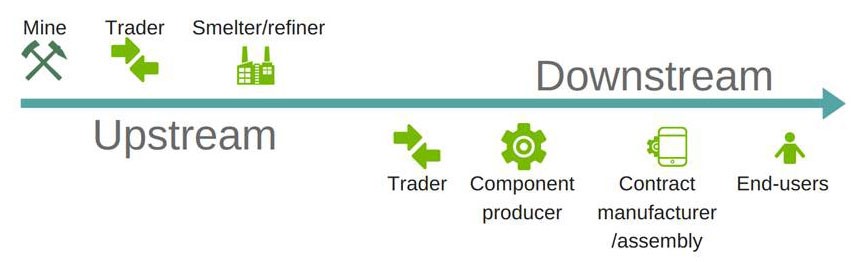

Firms that extract, process, and refine raw materials are called ‘upstream’ companies. The EU regulation identifies mining companies, raw material traders, smelters and refiners as upstream companies. Other parties, which the EU Commission calls “downstream” companies, process metals produced during the upstream stage into a finished product. The downstream stage includes the sale of the product to other businesses, governments, or private individuals.

The rules associated with the conflict minerals regulations are different for upstream and downstream companies though. Upstream companies are required to comply with the mandatory rules on due diligence when they import, as this is the most high-risk area of the supply chain. Downstream companies though, are classified into two categories. Downstream companies involved in importing metal-stage products have also been required to comply with the mandatory due diligence rules. However, those companies that operate beyond the metal stage do not have obligations under the conflict minerals regulations. These latter companies are expected to use reporting and other tools to make their due diligence more transparent. The European Commission estimates that there are approximately 880,000 EU-based companies operating in manufacturing sectors and working with tin, tantalum, tungsten, and gold.

In politically unstable areas, armed rebel groups often use forced labor to mine minerals. They then sell those minerals and use the profit to fund genocide and terrorism. At its simplest, the new law requires EU companies to ensure they import these minerals and metals from responsible sources only, according to the European Union.

According to the Conflict Mineral Benchmarking Study in 2015, the electronics industry was one of the most conflict-minerals compliant segments in U.S. manufacturing. This excessive demand, exacerbated by growth in the manufacturing activity, coupled with the spreading shortage of raw materials due to the pandemic, have cultivated a landscape of heightened demand and dangerously low supply. Raw material suppliers have begun to “name their price” and are charging buyers premiums for the stock they have available. While the new conflict minerals regulations are very honorable and necessary, they will likely intensify the already severe shortages. The jump in prices for raw materials will inevitably trickle down the supply chain and affect the prices and availability of electronic components and electrical components.

Bearing in mind the coming shifts in the electronic component industry, how can purchasers of electronic components prepare themselves for potentially turbulent times? Because even the most minor supply chain hiccups can produce a ripple effect of delays and withered profits, supplier diversification is a simple but critical measure to ensure a supply chain’s resilience through turbulent times. At Aegis Components, our global network of suppliers has been vetted and refined over the last decade. We also maintain strategically placed locations all around the world to help us locate and secure products globally and offer you the most competitive pricing and terms according to your delivery schedule.

Aegis Components provides electronic and electrical components from verified suppliers to ensure that the quality you expect is delivered every time.

Fill up the form and our team will get back to you within 24 hours.